Regarding assumable Virtual assistant fund, they may not be right for someone, with respect to the sort of property you are searching for and new terminology you are open to bad credit installment loans Rhode Island which have any new loan you signal for directly

- Not essential to agree: Even if you have discovered on your own an educated contract you can easily towards the marketplace, loan providers commonly necessary to approve people or all presumption financing. In some cases, you may have to seek out a lender that is unlock in order to coping with both you and prepared to agree a good Virtual assistant financing, providing you is actually licensed otherwise.

- Lending requirements continue to exist: Due to the fact financial loans are often a great deal more flexible with regards to so you’re able to and when an effective Va financing, it is vital to keep in mind that financing criteria continue to exist. When you find yourself thinking of committing to another house or assets that is available that have a keen assumable Va mortgage, just remember that , attempt to meet with the earnings and you can credit standards positioned so you can be eligible for new financing itself.

- A long time processes: Even though you have the capacity to place a deposit on a house and you can relocate as quickly as several weeks, a Virtual assistant assumable loan may require a tad bit more go out. Sometimes, the loan must also be approved by the brand new Va office itself, that can require weeks or as much as weeks accomplish. When you are dealing with a lender that perhaps not prior to now addressed assumable Virtual assistant fund, this will after that complicate the method.

With regards to assumable Virtual assistant loans, they are certainly not right for folk, depending on the variety of property you are searching for and you can the fresh new words youre open to with people the new loan your sign to possess privately

- Expectation flexibility: One of the most tempting aspects of a beneficial Va mortgage one to try assumable is the fact it could be believed because of the somebody who doesn’t always have armed forces feel or perhaps is a veteran. This means for as long as just one qualifies economically, he could be usually with the capacity of assuming a good Virtual assistant loan in the most common issues.

- Spend less on closing costs: In some cases in which good Virtual assistant mortgage exists, you will be able with the debtor or individual who is actually incase the loan to receive appraisals at no cost. While doing so, consumers that are of course Va loans have the capability to help save probably several thousand dollars on the closing costs, as these are also commonly safeguarded. Who will pay fees will feel calculated between your consumer and you will the vendor, you might still have to pay specific charges plus lender’s charge.

- Get access to Va advantages: While a provider relinquishes their Virtual assistant financing to some other buyer, the latest consumer assumes on the Virtual assistant mortgage experts, no matter if they aren’t energetic military otherwise experts on their own.

- Paid down financing fee: Most Virtual assistant funds enjoys a reduced money fee if they’re expectation fund more traditional Va financing. At the 0.5% of one’s loan amount, this is going to make Va assumable funds very enticing.

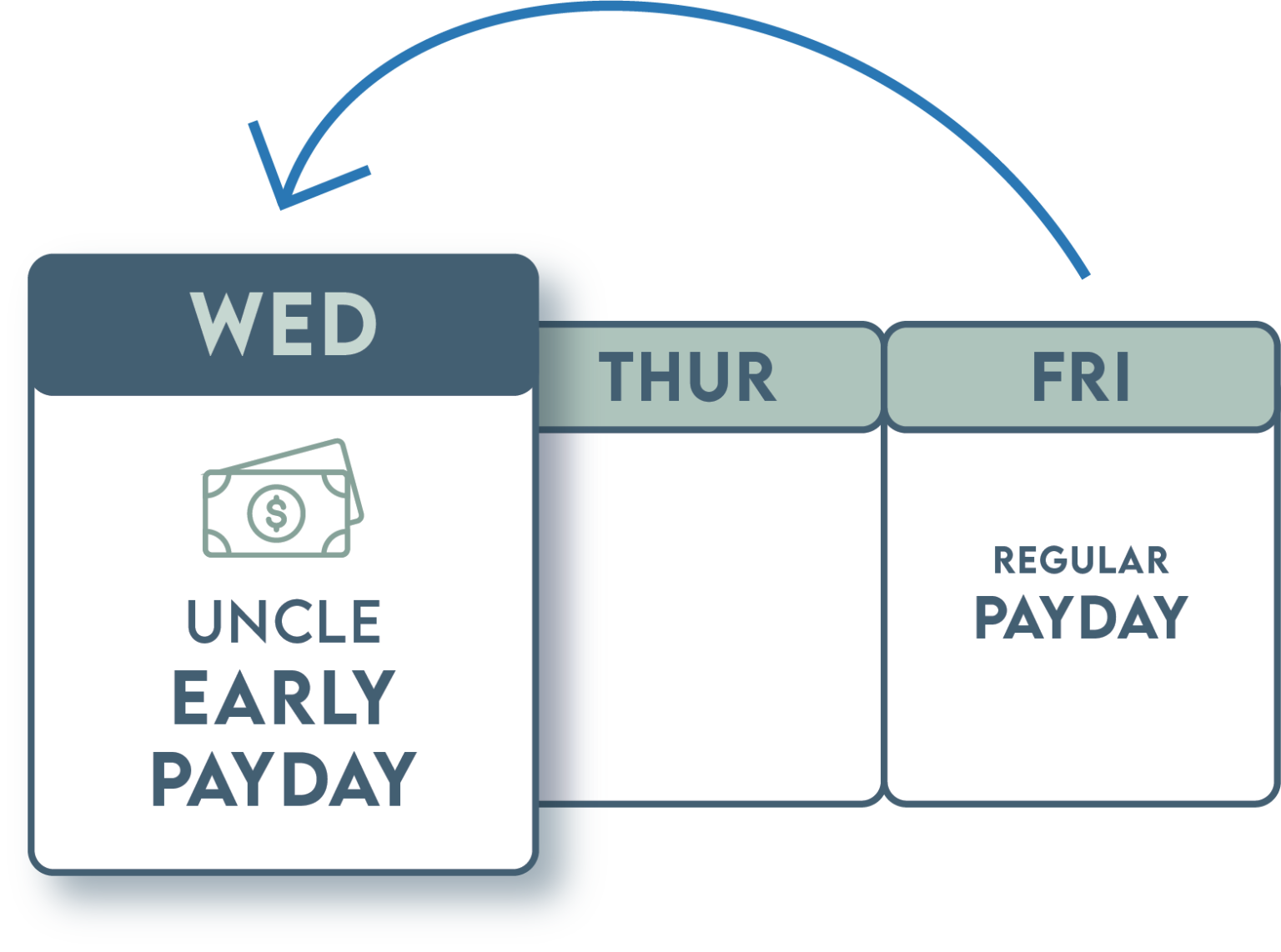

- Passed down rates of interest: You to reason a lot of group to imagine a good Virtual assistant loan try their ability to inherit set interest rates. In the event the an interest rate is lowest and secured inside the having a Va financing, its simpler into the the newest customer/debtor to imagine an identical loan rates of interest and you will terms of requirements in place of a fuss. This might be a better price than searching for a good antique mortgage.

Getting sellers, it’s important to note that the brand new Virtual assistant entitlement active remains with the property unless a special Va-licensed client gets control of the loan. This will be non-flexible and should not be removed otherwise treated later. You will have to pick be it worthwhile to get rid of out on this percentage of your advantages.