Searching for a mortgage and you will wondering how long the brand new term is? Including way too many anything, traditional understanding around 31-year mortgages could have been modifying. For many reasons, home buyers and you can lenders is actually examining different alternatives around the length out-of mortgages. Very and therefore length is right for you? Continue reading to learn more and the ways to make use of name duration for the best.

‘s the Average Term Size Right for Me personally?

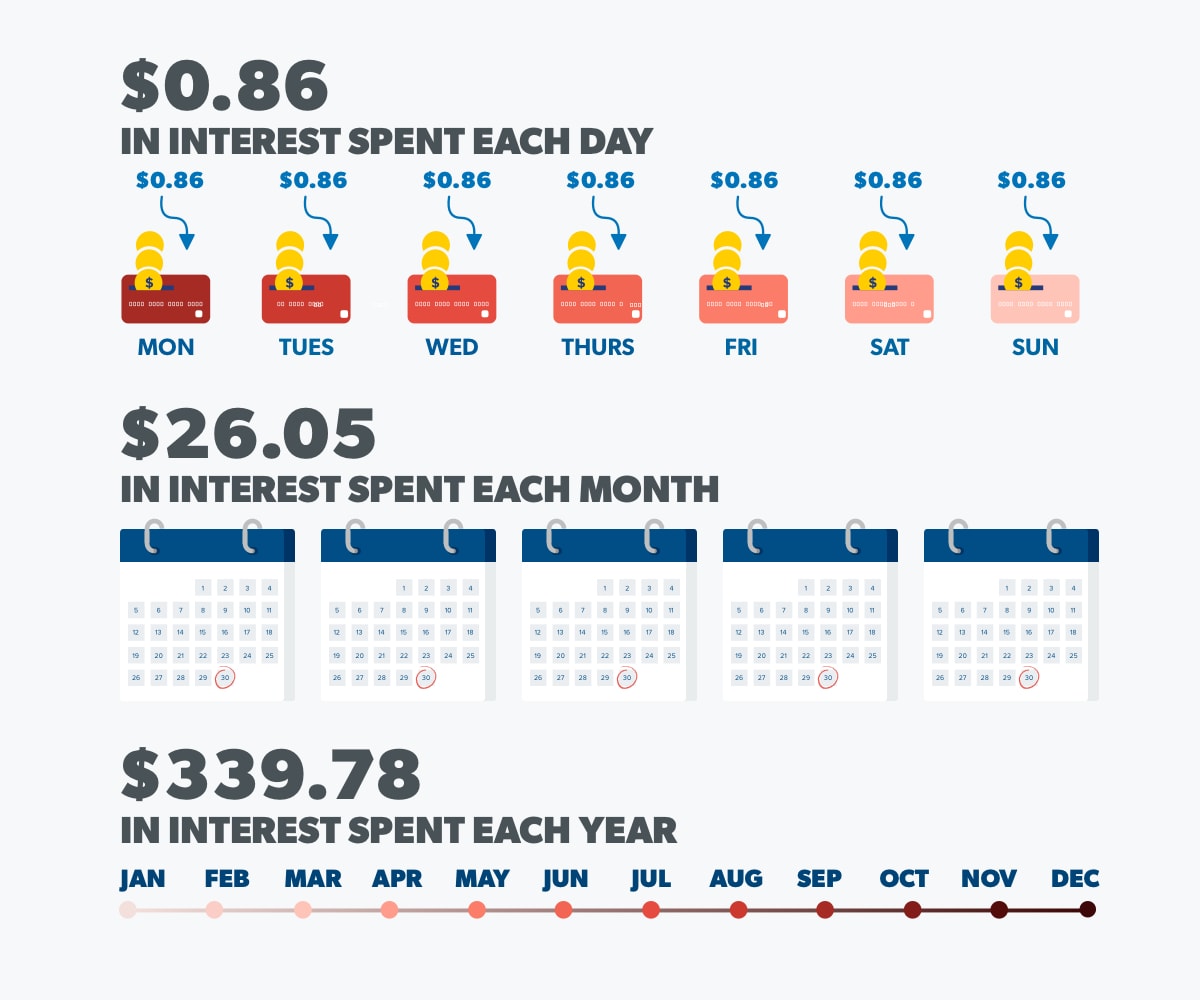

As a rule, faster financing conditions have high monthly mortgage repayments once the you will be distribute your instalments over to https://paydayloanalabama.com/pine-apple/ a smaller length of time. However, shorter loan terms and conditions also come which have down rates of interest. Which means you pay faster when you look at the attention along side lifetime of the loan.

A thirty-12 months Mortgage Identity

The latest 31-seasons mortgage is among the most prominent home loan available in the new U.S. as it develops costs out to 30 years, therefore it is less expensive, but you pay more when you look at the desire over time.

A great fifteen-12 months Mortgage Identity

Which have good 15-12 months mortgage, you will be making a higher monthly mortgage payment, you spend shorter appeal and construct security (the brand new portion of the house you possess) a lot faster.

The reduced interest rates towards the 15-year mortgage loans (as compared to 30-12 months mortgage loans) can be offset the highest month-to-month mortgage repayments as you shell out less towards household throughout the years.

Of several lenders render terminology in the 5-season increments one to range from ten 30 years. The fresh new monthly homeloan payment additionally the desire you only pay on loan often mainly confidence and that home loan term you choose.

Fixed-rates Financial versus. Adjustable-Speed Mortgage

All of the numbers about desk derive from fixed-price mortgage loans. Fixed-rate mortgages is actually fixed as the interest towards mortgage never ever changes.

(Sidebar: If you would like an interest rate that is lower than a fixed-rates mortgage’s rate of interest, consider trying to get a supply.)

As the basic speed period comes to an end, the rate often adjust from year to year. While you are a funds-mindful debtor who craves foreseeable monthly installments, understand that the rate to the an arm is also boost or fall off of the dos% 5% with each variations.

Fingers are just the thing for men and women going to reside in a home just for a couple of years. This permits brand new homeowner to obtain the lower interest rate you are able to till the part of attempting to sell.

Most Repayments

Uncertain it is possible to pay the large costs you to definitely include a shorter home loan identity, however, do you want to reduce the loan a small reduced? Spend a little extra on your own mortgage principal per month or generate a supplementary percentage once a year.

Also some extra cash applied to the latest loan’s prominent is shave many years and you will thousands of dollars in notice out-of your own mortgage loan.

How to Discover home financing Title?

There’s no universal solution to the question at which home loan term is right for you. However, you will find questions you could ask yourself prior to making a final decision.

How much of Money is it possible you Put Towards Your Financial?

Can you imagine you’re thinking about a 30-seasons home loan. You crisis the fresh number and determine one 28% of one’s month-to-month income will cover your own month-to-month mortgage payment which have just a few hundred dollars or more in order to free.

If you have currency in order to spare plus don’t possess too-much high-desire debt (for example playing cards), it’s also possible to make use of a smaller 20-year otherwise fifteen-seasons mortgage. Otherwise, stick with the reduced monthly home loan repayments regarding expanded-label financing. But, obviously, you can always build even more payments or re-finance their financial when you really have extra money.

Preciselywhat are Your Other Financial Requirements and Challenges?

If you many loans, such as for instance college loans, auto loans, otherwise handmade cards, you ought to manage using those from. Taking an extended financial that have less monthly payment might help release bucks you need to settle the money you owe.

When you’re relatively personal debt-totally free and also most, throwaway cash, while making higher monthly payments having a shorter financial identity will help your create domestic security shorter and save you money into the home loan focus.

How much cash Would you Pay Initial?

If one makes a downpayment out-of 20% or quicker, you are able to pay mortgage insurance rates every month unless you enjoys that loan-to-worth (LTV) ratio (extent you borrowed from separated from the appraised value of your own home) out-of 80% otherwise reduced.

Really mortgage loans incorporate settlement costs. The expenses are often doing cuatro% 6% of the financing. Specific lenders allows you to bend the expense into the mortgage if you’re unable to afford to shell out your closing costs at the closing. That will help decrease your initial costs, but it addittionally increases the total cost of financing.

Where Are you willing to Find Yourself during the 5 ten years?

The latest extended the loan name, more you’ll pay within the focus at the beginning of your financial label, therefore the faster family possible own. If you want to lower your own home loan smaller and that means you can also be earn significantly more once you promote your house inside the 5 ten years, a shorter financial title makes it possible to build way more security. Security is actually money that comes back to you once you promote your home.

Conclusion

You’ve got lots of options with respect to selecting an interest rate label. Being aware what duration of financing works for you are going to come down seriously to taking a reputable check your finances – and requirements.

Very, just what title suits you? It will be the name one impacts best equilibrium between cost and you will your own plans on the family as well as your future.