Taylor Milam-Samuel try an individual financing journalist and you will banks that give high risk loans credentialed educator that is passionate about enabling anyone manage its money and build a lifestyle it like. Whenever the woman is not evaluating financial small print, she can be discovered regarding the classroom knowledge.

New United Features Auto Connection (USAA) is a tx-built standard bank offering professionals individuals lending products. In order to meet the requirements, you truly must be a veteran, active-obligation army service affiliate, otherwise immediate relative.

Membership boasts beneficial benefits such as usage of insurance policies things, travel deals, full-services banking, and you can fund. Regardless of the benefits, USAA not also offers figuratively speaking.

As to the reasons doesn’t USAA give college loans?

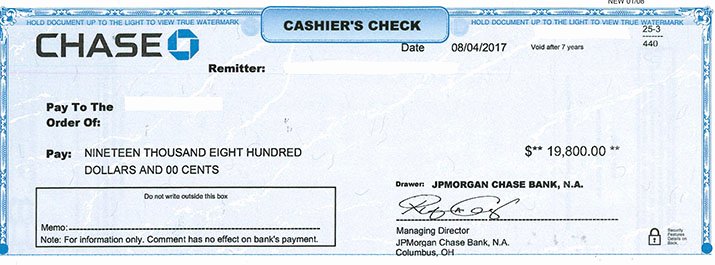

USAA not any longer even offers figuratively speaking. When you look at the 2017, the business deserted the relationship having Wells Fargo, and this acceptance they to situation personal figuratively speaking to help you eligible professionals with a good 0.25% disregard. Of numerous participants are now actually looking choice.

When you yourself have good USAA student loan into the installment, the termination of the connection cannot effect your. You can keep paying down the loan because organized. In case you will be a beneficial USAA affiliate looking an educatonal loan, believe other choices.

There are two version of college loans: government loans and personal money. In advance of 2017, USAA given personal figuratively speaking, bringing flexible capital having academic expenditures.

Private figuratively speaking are around for mothers and you can youngsters which qualify. Pricing and conditions rely on your credit score, loan amount, or other products.

Since you seek solution financial institutions, evaluate these four loan providers, as well as one to especially for army players in addition to their group.

Navy Government Borrowing from the bank Connection: Good for military individuals

- Members-merely borrowing from the bank relationship on armed forces area

- Borrowers usually do not stop money during college

- Consumers can also be make use of Navy Federal’s Career Recommendations Apps, and a resume builder

To own armed forces members, a student-based loan of Navy Government Borrowing Relationship is among the most similar substitute for an effective USAA loan. Such USAA, Navy Federal is a players-just credit partnership you to definitely caters to the newest armed forces neighborhood in every fifty says. The business offers an easy on the web app processes having student and you will scholar funds, so there are not any fees.

You need to be a part to apply for financing. To be eligible for subscription, you really must be a dynamic, resigned, experienced provider user otherwise a direct family member. Company regarding Safeguards (DoD) civilians may feel people.

Cosigners are not expected, but the majority of scholar borrowers will require (otherwise need) to include one to be eligible for best financing conditions. Navy Federal quotes nine regarding ten education loan people provides a cosigner.

Navy Government need borrowers making attention-simply otherwise $twenty five monthly payments at school. The installment title was 10 years. not, Navy Federal cannot costs a prepayment penalty, and consult good cosigner launch after 2 years from successive repayments.

University Ave: Most readily useful total

- Extensive loan alternatives, as well as undergraduate, graduate, moms and dads, and you will career degree

- Favor their repayment term

- Financing for up to 100% of education expenditures

College Ave even offers student loans in order to undergraduates, graduates, and you may moms and dads. The lender even offers funds for occupation training software. The latest loans can cover up so you’re able to 100% away from informative costs, as well as university fees, guides, and space and panel.

The lending company also offers five installment title choice-five, eight, ten, or 15 years. Consumers can also be put-off repayments up until immediately after college or university or choose one of around three within the-university fees preparations. Very individuals want a cosigner becoming qualified. Once completing over 1 / 2 of the newest arranged installment months, you can request a cosigner launch.

There aren’t any software, origination, or prepayment penalties, and you will consumers may good 0.25% Apr discount to possess setting up automated payments. Even though the business now offers aggressive costs and terms, it will not keeps specific advantageous assets to solution users.