Particular Mortgage Costs

Home buyers searching for a reasonable home loan can be compare various rates and see a knowledgeable complement the state. The 2 sorts of home loan prices was repaired-speed mortgage loans and you can adjustable-rates mortgage loans. (ARMs)

Variable Speed Financial vs. Fixed

Fixed-Speed Financial: A home loan with an intention rates one remains the same in the longevity of the loan. Consequently the monthly installment amount will continue to be the same. Individuals can also be imagine the entire client closing costs and you may package in the future of your time.

Adjustable-Speed Home loan: A mortgage has an interest rate you to definitely change along side lifetime of the mortgage. The speed can vary from month to month considering field spiders. How frequently the speed alter hinges on the loan contract.

The brand new monthly obligations is myself proportional on style of focus rate you choose. You could estimate the very last charges for the house you need to get according to your financial updates and you may particular loan terms.

15-, 20- and you may 30-12 months Mortgage loans

A property buyer can choose the period to settle the loan. It does be either a beneficial fifteen-seasons fixed price home loan or a 30-12 months adjustable price financial.

A short-term loan, such a great fifteen-12 months or 20-seasons loan, setting high monthly premiums. not, might spend substantially lower than the interest towards a thirty-year mortgage.

You could potentially decide which version of home loan months is better built on the finances, like most recent money and you will property.

What Has an effect on Financial Pricing?

Whenever credit money for buying property, the loan interest are going to be a forerunner in order to how much the home will cost. The standards which affect financial cost supply a job to help you play here.

- Inflation

- Federal Set-aside Monetary Policy

- Financial Rate of growth

- Housing marketplace Conditions

Home loan Pricing and you may Housing market

In the event the financial costs try large, you’ll encounter minimal home buyers choosing to get a home loan, and you will land tend to save money weeks on the industry, so it’s a consumer’s sector.

In case your mortgage cost is reasonable, upcoming there are so much more buyers bidding for characteristics. Domestic sales might be shorter, and you will homes from inside the fashionable towns and cities might winnings the fresh new bidding conflict amidst numerous also offers, making it a hot seller’s market.

Particular Mortgage loans

1. Government-Backed Mortgage loans: Brand new U.S produces owning a home across The usa having FHA, Virtual assistant and you can USDA loans. The us government isnt a loan provider right here, but i have organizations like the FHA (Federal Construction Relationship), USDA (All of us Agencies regarding Agriculture), in addition to Va loans for truck driver training (Veterans Administration Agencies). to get your financial canned through available lenders.

3. Jumbo Funds: Loans one slip ways above the general credit constraints. Best suited for individuals thinking of buying a pricey assets

4. Fixed-Rate Mortgage loans: An interest rate where the interest rate is restricted and you can cannot change over the latest lifetime of the borrowed funds.The brand new payment per month will not transform up until the financing are closed.

5. Adjustable-Price Mortgages: An interest rate the spot where the interest rate alter according to the frequency arranged into the lender. The monthly payment will be different along the longevity of the loan.

- Balloon Mortgages

- Piggyback Financing

- Difficult Money Loans

- Framework Finance

Getting home financing?

Systematically plan the property get. Out-of strengthening your credit score in order to trying to find the house you want, everything you needs time to work. A step-by-step technique to get home financing normally turns out this:

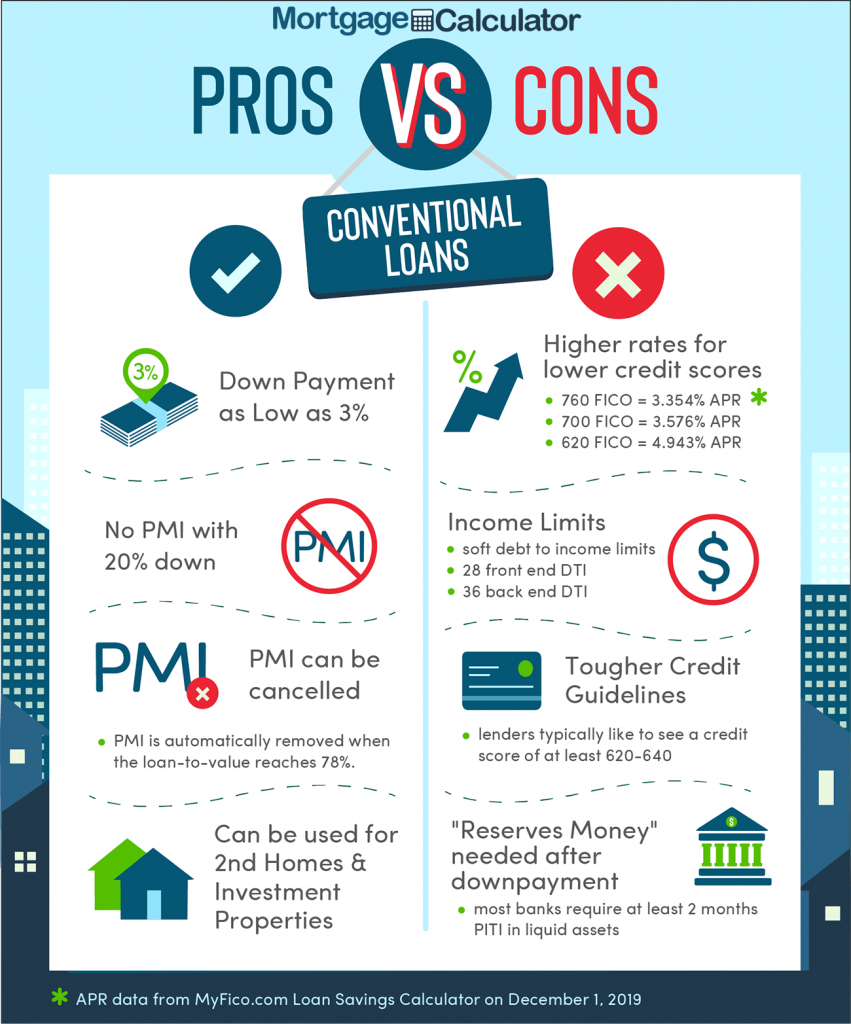

- Improve Credit rating: To cease purchasing higher attention, you must boost your credit score. And make prompt repayments to suit your financial obligations can assist change your rating over time. Despite a poor credit score, you should buy a home loan, nevertheless the interest rate will be somewhat large.