Welcome to the remarkable world of live pocket option trading live pocket option trading, where financial markets meet innovative technology. As a trader, whether you are a novice looking to make your first trade or an experienced trader aiming to refine your strategies, understanding how to navigate the live pocket option trading environment can significantly boost your success. This article aims to guide you through essential concepts, strategies, and best practices in live pocket option trading, helping you to maximize your potential in this dynamic domain.

Understanding Pocket Option Trading

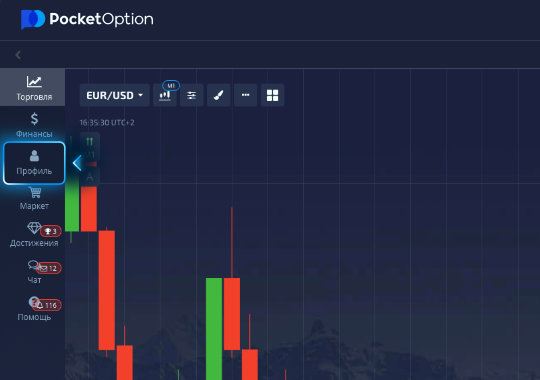

Pocket Option is a popular online trading platform that offers binary options trading. It allows traders to forecast price movements of various assets, including forex, commodities, and cryptocurrencies. The essential premise of live pocket option trading is predicting whether the price of an asset will rise or fall within a specified time frame. The simplicity of setting up an account and executing trades has made it a favored choice for many traders.

The Mechanics of Live Trading

In live pocket option trading, traders can enter positions in real-time, responding to market dynamics as they unfold. This immediacy offers an exciting opportunity for those who thrive on quick decision-making. To participate, you need to set up an account, deposit funds, and start trading. The key elements involved in live trading include:

- Assets: Traders can choose from various assets, including stocks, forex pairs, commodities, and cryptocurrencies.

- Trade Types: Options often include commodity options, digital options, and Forex options, each with unique characteristics.

- Time Frames: Traders can select different expiry times, ranging from 60 seconds to several hours, allowing for strategies that suit their trading goals.

Choosing the Right Strategy

To succeed in live pocket option trading, having an effective strategy is crucial. Here are some strategies that traders commonly use:

1. Trend Following

This strategy involves analyzing market trends to determine the potential direction of an asset’s price. Traders using this approach will typically enter a trade when they identify a strong trend and place their bets on the continuation of that trend.

2. Support and Resistance Levels

Support and resistance levels are crucial indicators in technical analysis. By identifying these levels, traders can forecast potential reversals or continuations in price movements. Placing trades near these levels can enhance the likelihood of successful outcomes.

3. News Trading

Economic news releases and geopolitical events can heavily influence market movements. Traders who stay informed on relevant news can capitalize on volatility by positioning their trades accordingly around significant events like central bank meetings or economic reports.

The Role of Technical Analysis

In live pocket option trading, technical analysis plays a vital role. By studying charts, patterns, and indicators, traders can gain insights into price movements and make informed decisions. Popular technical indicators include:

- Moving Averages: These indicators help identify trends by smoothing out price data over specific periods.

- Relative Strength Index (RSI): This momentum indicator measures the speed and change of price movements, indicating overbought or oversold conditions.

- MACD (Moving Average Convergence Divergence): This indicator shows the relationship between two moving averages of an asset’s price, aiding in trend determination.

Risk Management in Live Trading

Effective risk management is essential in live pocket option trading. Traders must protect their capital while pursuing profits. Here are some key points to consider:

- Setting Stop-Loss and Take-Profit Levels: These predefined points can help limit losses and secure profits.

- Risk-to-Reward Ratio: Understanding the potential reward in comparison to the risk taken is crucial for long-term success.

- Diversification: Spreading investments across different assets can help mitigate risks associated with any single trade.

Emotions and Trading Psychology

Trading is not just about strategies and analysis; it also involves emotional discipline. Fear and greed can derail even the best trading plans. Traders must cultivate a mindset that promotes rational decision-making and resist the urge to act impulsively. Techniques such as journaling trades, reflecting on emotional responses, and adhering to a trading plan can enhance psychological resilience.

Continuous Learning and Adaptation

The financial markets are ever-evolving due to a myriad of factors, including economic conditions, technological advancements, and market sentiment. Traders engaging in live pocket option trading should commit to continual learning. This may involve:

- Reading books and articles on trading techniques.

- Participating in webinars and online courses.

- Engaging in trading communities to share insights and experiences.

Conclusion

In conclusion, live pocket option trading presents a thrilling yet challenging environment filled with opportunities for skilled traders. By understanding the core principles, employing effective strategies, managing risk, and maintaining emotional discipline, traders can enhance their ability to achieve success in this fast-paced world. Remember, becoming proficient in live pocket option trading takes time, practice, and ongoing learning. Equip yourself with the knowledge and tools necessary to navigate the exciting world of trading, and you’ll be well on your way to reaching your financial goals.