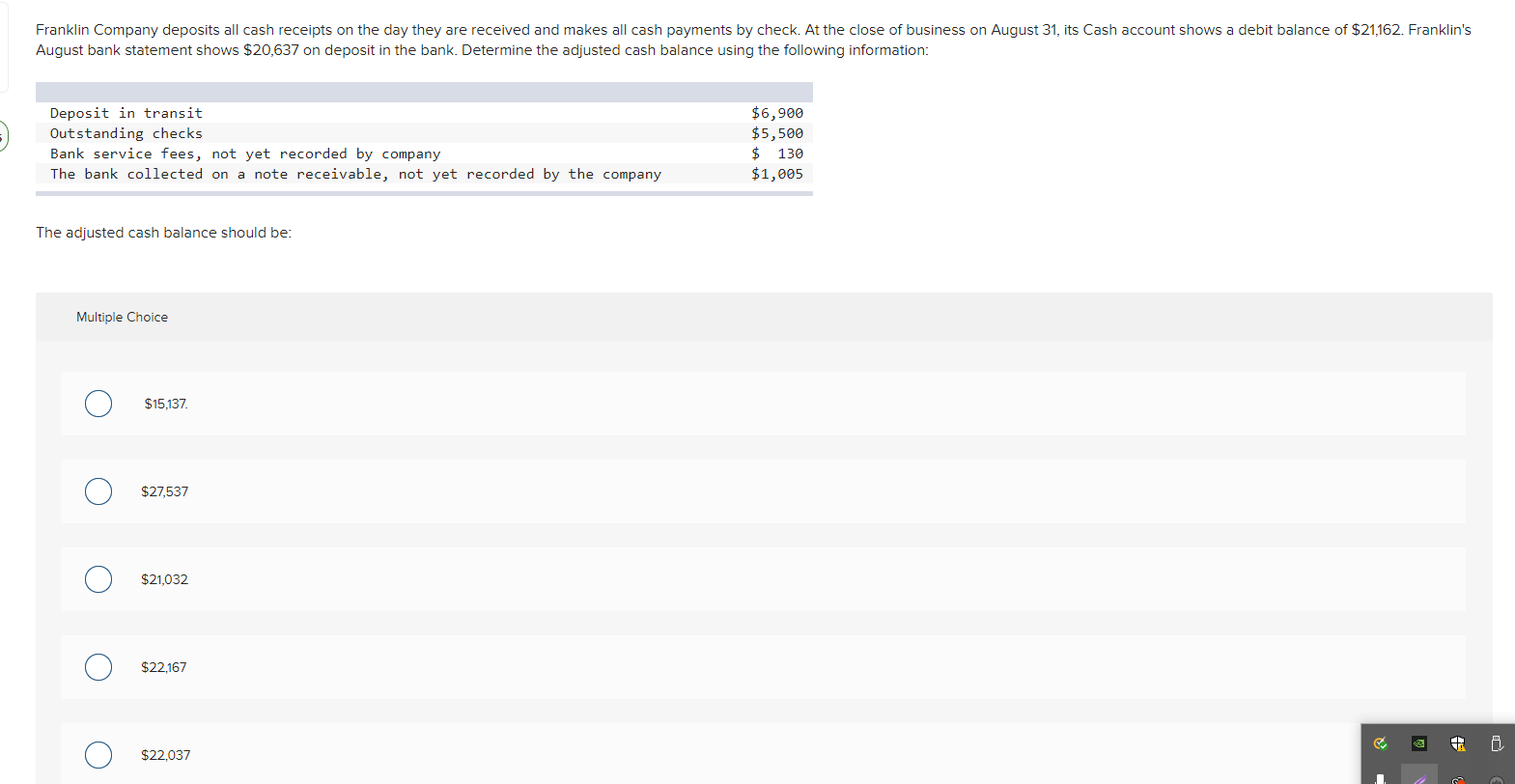

Purchasing your basic household might be huge economic difficulties. To qualify for a mortgage, you usually have to set out some money even although you want to funds almost all of the get. That it down-payment can add up to a large number of dollars, especially in large-cost-of-traditions components.

Recite customers may be able to use the proceeds of your product sales from a past house, in addition to potential collateral progress, to the the downpayment. But first-day homeowners do not have you to definitely advantage, and regularly need certainly to decide between make payment on lowest advance payment so you’re able to be eligible for the financing and you may and work out more substantial down payment you to you can expect to eradicate its mortgage can cost you ultimately. If you’re in this instance, some tips about what to consider since you arrange for the advance payment.

Secret Takeaways

- First-time homebuyers makes smaller off money as compared to mediocre homebuyer.

- An average earliest-go out homebuyer deposit is about 7% of the purchase price, according to the Federal Association regarding Realtors.

- To make more substantial deposit reduces the riskiness of your mortgage to the financial, that end up in down interest rates and not having to pay for home loan insurance anyway or even for for as long.

- Whenever saving for a downpayment, it’s adviseable to plan for settlement costs or any other unanticipated expenditures which come up for the house buy techniques.

Mediocre Family Off Payments

Brand new average home down-payment in 2021 is actually a dozen% of your house’s purchase price, according to National Connection of Real estate agents (NAR). Recite consumers, who had previously owned other assets, had a tendency to provides large down costs (17% of your own price), and you can earliest-day homeowners had a tendency to set-out eight%.

The most significant challenge for some homebuyers are preserving upwards for the down-payment, told you Melissa Cohn, regional vp at the William Raveis Financial. First-time homeowners will generally need certainly to go into the areas as soon because they can, according to research by the fund they actually have.

The 2 chief resources of funds available to first-time homeowners is her savings and you can merchandise from household members, according to the NAR. Off money to possess 58% from homeowners in 2021 were based on discounts. Almost every other high sources of downpayment fund become:

- Gifts from family otherwise relatives

- Fund from family or family relations

- Inheritances

- Credit off senior years funds

- Income tax refunds

When you’re just eleven% of all of the customers for the 2021 cited protecting right up to the down payment as the most hard a portion of the homebuying techniques, which was happening having 25% out-of people ages twenty two to help you 30. For these younger consumers-that are, on average, likely to end up being very first-time homeowners-coming up with a deposit are a primary difficulty.

Mortgage Options for Various other Down Money

Specific authorities-supported mortgage applications, including USDA financing and you will Va money, provide zero-down-payment alternatives, as you can invariably prefer to spend a down-payment.

Getting traditional finance, a minimal available advance payment amount is frequently step three%, but not visitors usually qualify for that loan that have a lower commission you to reduced. 5% down-payment.

For jumbo money, being too large so you can qualify for old-fashioned look at this now compliant financing, down-payment number are normally taken for lender in order to lender however they are have a tendency to a lot higher, demanding individuals to place down 20% otherwise twenty five%.

Imagine if You don’t have 20%?

Although lenders and you may financial professionals often point out this new economic benefits of and work out an effective 20% down payment, it’s just not always you’ll be able to. Choosing to lay out lower than 20% means you will be necessary to pay for individual financial insurance (PMI). PMI covers loan providers regarding the possibility of your defaulting into financing, and it’s really a good way fund could be more costly full having a lesser down-payment.